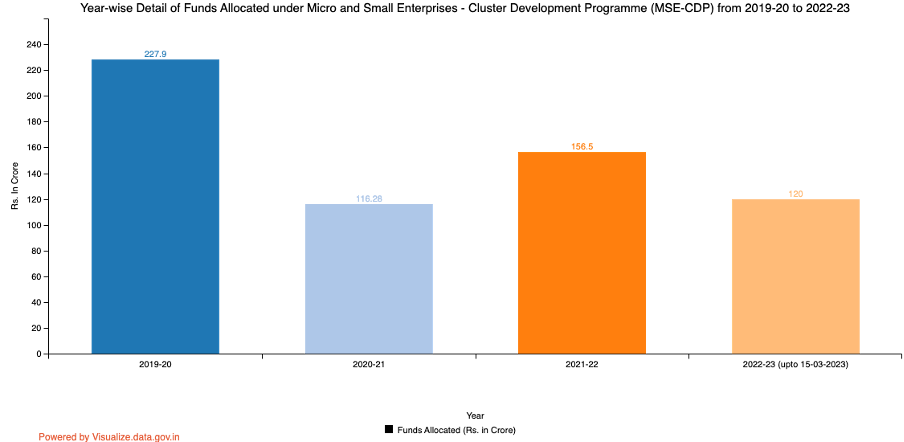

In India, the Micro and Small Enterprises – Cluster Development Programme (MSE-CDP) is an essential program aimed at encouraging the growth and development of small-scale enterprises. The program’s effectiveness is dependent on the allocation and utilization of funding for the improvement of these businesses. This blog delves into the year-by-year breakdown of money allocated and actual spending under MSE-CDP from 2019-20 to 2022-23.

(The Micro and Small Enterprises – Cluster Development Programme (MSE-CDP) is an Indian government effort aimed at promoting the growth and development of the country’s small and micro-sized businesses. It accomplishes this by grouping small enterprises into clusters, giving financial assistance and resources, and training to help them grow. The program aims to make these small businesses more competitive and sustainable, thereby contributing to India’s economic growth and employment creation.)

money allocated & actual spending under MSE-CDP from 2019-20 to 2022-23

- 2019-20: Laying the Foundations

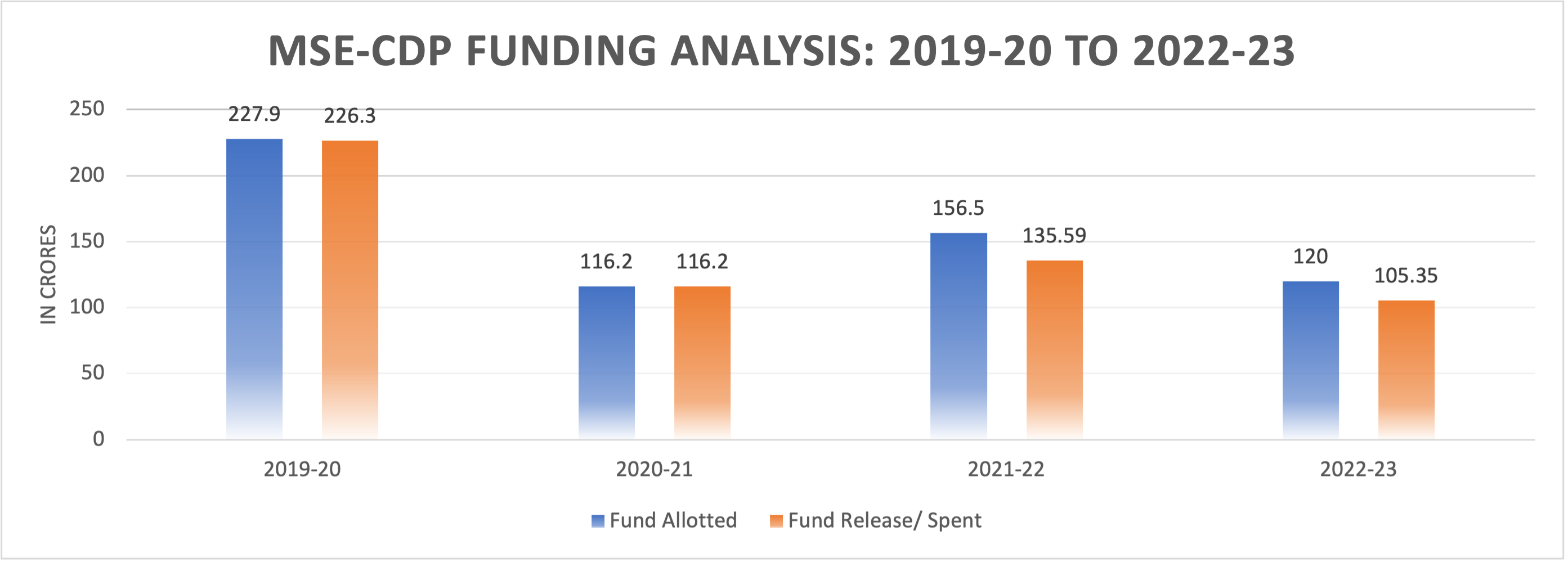

Funds Allotted: The program received a major allocation of 227.9 crores in the fiscal year 2019-20. This grant demonstrated the government’s commitment to strengthening the micro and small business sectors.

Funds Released/Spent: An impressive 226.339 crores were disbursed, indicating that the allocated funds were used efficiently. This practically 100% utilization indicated a promising start to the MSE-CDP journey for this year.

- 2020-21: Maintaining Momentum

Funds Allocated: The government continued to fund MSE-CDP in 2020-21 by allocating 116.28 crores, which was marginally less than the previous year.

Funds Released/Spent: The allocated funds were completely spent, demonstrating an unrelenting commitment to the program. This complete utilization kept the momentum going.

- 2021-22: A Dip in Spent Funds

Funds Allocated: The allocation for 2021-22 was 156.5 crores, indicating a renewed interest in the development of micro and small firms.

Funds Released/Spent: However, there was a significant decrease in funds spent, with only 135.59 crores used. While the allocation was significant, the expenditure was slightly lower than the previous year, possibly signaling the need for more efficient spending or a re-evaluation of program aims.

- 2022-23 (up to 15 March 2023): Navigating Challenges

Funds Allocated: As of March 15, 2023, 120 crores have been allocated for the MSE-CDP year 2022-23. The allocation was lower than in previous years.

Funds Released/Spent: Up to this date, 105.35 crores have been spent, indicating that a significant percentage of the allocated funds has already been put to good use. However, it should be noted that the fiscal year was not yet over.

Important Takeaways

- Consistent Financial Assistance: The government has constantly provided financial assistance to MSE-CDP, albeit with minor fluctuations in allocations.

- Efficient Spending: During the first two years (2019-20 and 2020-21), practically the whole allotment was spent, indicating efficient use of money.

- Future Challenges: The decrease in funds spent in 2021-22 raises concerns about the program’s efficiency and whether it requires changes to effectively accomplish its objectives.

- Continued Commitment: As of March 15, 2023, a large percentage of the budget for 2022-23 has already been spent, suggesting a continued commitment to MSE-CDP.

In conclusion, a year-by-year analysis of MSE-CDP funds allocated and spent from 2019-20 to 2022-23 reveals both accomplishments and challenges.” It emphasizes the importance of not just budget allocation but also the critical requirement for their proper utilization in promoting the growth of micro and small businesses. These companies are vital to Tezi Bharat, India’s fast-developing economy. This assessment also highlights the need for potential tweaks and revisions to ensure the program’s long-term success in supporting economic development and creating job opportunities in the nation’s ever-changing path.

Leave a Reply