A considerable quantity of capital is required to start, run, or expand a business. There are numerous business loan solutions accessible in India to meet the different financial needs of entrepreneurs. There is a loan suited for you whether you want to purchase new equipment, cover working capital expenses, or enhance your start-up. In this article, we’ll look at some of the most prevalent forms of business loans in India and offer advice on how to choose the best one for your individual needs.

- Term Loan

Term loans are an important financial tool for companies. They provide a lump sum payment that is returned in fixed monthly installments over a certain length of time, usually one to five years. These loans are versatile and can be utilized for a variety of objectives, including the purchase of equipment, the expansion of inventory, and the financing of working capital. They are a fantastic alternative for companies with well-defined financial objectives and the ability to make regular payments.

- Working Capital Loan

Working capital loans are intended to fund the day-to-day operations of a firm. These short-term loans give the required cash to fulfill payroll, purchase merchandise, or finance marketing efforts. They are typically returned within a year, making them excellent for filling short-term cash flow deficits.

- Equipment Loan

An equipment loan is a good option for businesses wishing to purchase specialized equipment. Because the bought equipment frequently has a longer lifespan, these loans have longer repayment terms. Equipment loans enable you to invest in assets critical to your business without jeopardizing your working capital.

- Invoice Financing

Invoice finance is a useful tool for organizations that have unpaid invoices. It allows you to borrow money against your outstanding bills, providing you with an immediate cash inflow. This is especially useful if the business has a long sales cycle or needs funding to sustain quick expansion. Invoice financing keeps your cash flow stable even when clients take their time paying their bills.

- Line of Credit

A line of credit is a revolving loan that gives a pre-approved credit limit to businesses. You can withdraw funds as needed, and the interest is only paid on the amount borrowed. It’s a versatile financial tool that may be used for everything from bridging short-term shortfalls to capitalizing on fresh opportunities.

- Government-Backed Loans

The Indian government provides a variety of credit programs to help small businesses and entrepreneurs. When compared to traditional loans, these loans often have lower interest rates and more flexible payback terms. They are intended to stimulate economic growth and are worth investigating, especially if you match the eligibility requirements.

Factors to Consider When Choosing a Business Loan

Selection of the ideal business loan requires careful evaluation of several crucial factors:

1. Purpose: Specify the particular reason for which you require the loan. Different loans are designed to meet specific needs.

2. Loan Amount: Determine how much funding you will need for your business. Borrow only what you need to save money.

3. Repayment Terms: Determine your ability to make monthly payments and select a loan with terms that fit the cash flow of your business.

4. Interest Rate: Interest rates vary greatly amongst lenders. Shop around for the most affordable prices that meet your budget.

5. Eligibility Criteria: Understand and meet the eligibility requirements for each loan.

Additional Tips for Choosing a Business Loan

- Credit Score: The interest rate you obtain is influenced by your credit score. A higher score frequently results in more favorable terms.

- Pre-Approval: Getting pre-approved provides you with a better idea of how much you can borrow and what interest rate you can get, which can help you negotiate better conditions.

- Compare offers from numerous lenders to find the best fit for your company. Examine the interest rates, repayment terms, and any connected expenses.

- Read and understand the terms and conditions carefully before signing any loan arrangement. If necessary, seek legal or financial assistance.

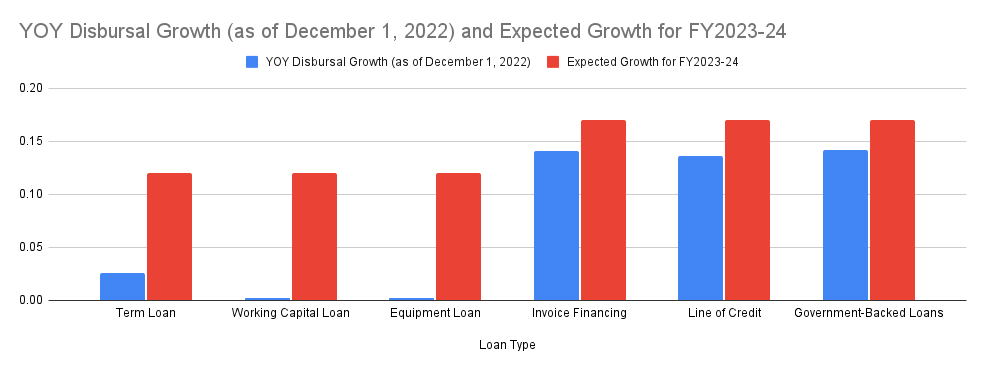

Here’s a table showcasing the year-on-year disbursal growth and expected growth for FY2023-24 of each loan type:

Source: MFIN Micrometer, IBA Annual Report, IBA Quarterly Statistical Report, RBI Annual Report and RBI Monthly Bulletin

The financial landscape is diverse and dynamic for Indian enterprises. Tezi Bharat, the growing national initiative to boost Indian industry, is an important thread in this economic tapestry. If you have a strong understanding of the available loan choices and carefully analyze your business’s particular demands, you can make informed decisions to obtain the appropriate money. Whether you’re a first-time entrepreneur, a seasoned business owner, or a visionary looking to expand, the right business loan can be a key stepping stone to your success.